Euro/USD

The EUR/USD pair has pulled back a little as we enter the European trading session after hitting a more than 2-month high last Friday on the back of a disappointing jobs report from the US which adds evidence that a rate hike in the world’s biggest economy is still some time away.

The release of the non-farm payrolls figures showed that the US economy added 372K new jobs in August which was well below analysts’ expectations for a figure of 750K rise while. The Unemployment Rate fell to 5.2% which was slightly better than last month’s figure of 5.4%.

Apart from leaving interest rates on hold, many in the market now predict that the US Federal Reserve will leave their stimulus plan in place for a little longer while the European Central Bank may be about to take steps to limit their emergency bond-buying program.

ECB Vice President Luis de Guindos recently mentioned that he happy at the current state of the Eurozone’s economic recovery which should pave the way for the eventual withdrawal of the stimulus package.

Today is a public holiday in the US, which means the economic news coming to the market is practically non existent, and we expect a quiet day for the EUR/USD currency pair. The action should pick up tomorrow with the release od GDP figures from the Eurozone.

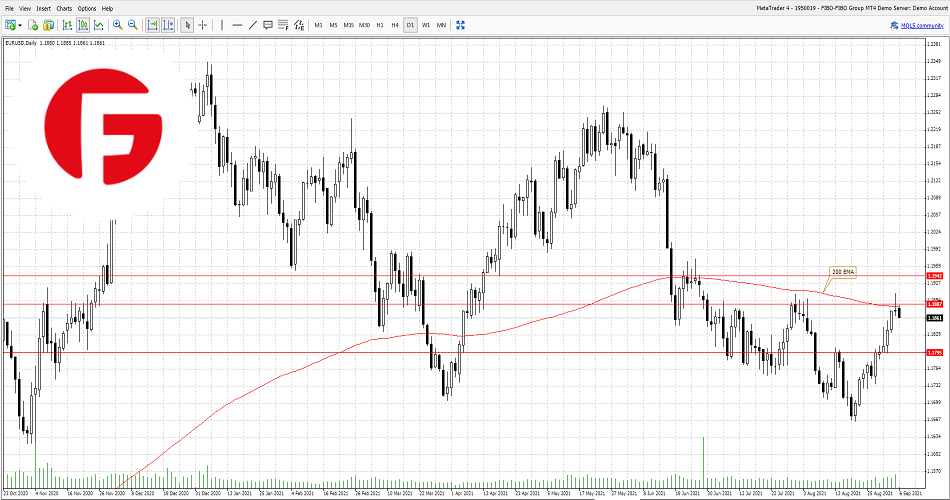

On the chart we can see the Euro was able to break above the 200 day EMA on Friday but the rally was short lived and in today’s trading session this critical resistance level has once again proved to be a sticking point.

if we can break above this level over the next couple of trading sessions it is very likely that this pair may head for much higher levels and we may see a run to the next resistance level of $1.1946.